|

Investments and The Exponential

Model

Most financial institutions uses the exponential model to apply interest

to funds invested into most of its accounts. Some investment options are

set by the financial institution such as bank interest rate on mortgages

or the interest rates may vary over several terms of the investment or

loan.

These models are mostly exponential growth models (unless an investment

is losing values). They are exponential growth models because growth is

applied per period by a fixed percent.

In most of today's exponential models the percent rate may varies with

time, but in this text we will only concern ourselves with fixed rates

per period.

When an investment, B, follows an exponential growth model

with a fixed rate per period, say a period of one year, the investment

model with respect to time is written as:

Annual Interest Rate:

| Yearly Exponential Growth Model,

i.e. Interest is applied at a fixed percent rate at the end of each year.

,

where Bt is the balance at time t,

year, B0 is the initial investment amount and r

is the decimal equivalence of the yearly percent rate. ,

where Bt is the balance at time t,

year, B0 is the initial investment amount and r

is the decimal equivalence of the yearly percent rate.

|

Whenever the interest or rate of growth per period is yearly we call

that the annual rate or nominal rate.

Example 4.9 Find the balance in a checking account after 5 year,

if $2,000 was originally deposited into the account yielding an annual

interest rate of 3.5%.

This is an exponential growth model with an periodic or yearly interest

rate of 3.5% or r = 0.035.

So  , the balance in the checking account after t=5 years.

, the balance in the checking account after t=5 years.

This process of apply an interest to the balance of an account or fund

per defined period is called compounding. For year interest rate increases

we have a yearly compounding.

Compounding Greater

than Yearly

| If n is defined as

the number of period in a year, then we define periodic compounding

as:

,

where Bt is the balance at time t,

year, B0 is the initial investment amount and r

is the decimal equivalence of the yearly percent rate. ,

where Bt is the balance at time t,

year, B0 is the initial investment amount and r

is the decimal equivalence of the yearly percent rate.

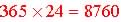

Example compounding is monthly, n = 12; quarterly, n =

4, daily, n = 365 |

Continuous Compounding

When the number of compounding per

yearly is large, even greater than hourly where,  we defined this as continuous compounding:

we defined this as continuous compounding:

,

where Bt is the balance at time t,

year, B0 is the initial investment amount and

r is the decimal equivalence of the yearly percent rate. ,

where Bt is the balance at time t,

year, B0 is the initial investment amount and

r is the decimal equivalence of the yearly percent rate.

|

With all these various types of compounding one often need to evaluate

each compounding as its compares to the yearly compounded interest rate,

we call this normalization the Effective

Annual Rate.

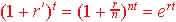

The Effective Annual Rate is found by setting the various compounding

equal to each other and finding the equivalence to the yearly rate of r',

from (1+r').

Or

Divide by B0 we get

Or

Or

So the effective annual rate for periodic compounding is the solution

of r' from

,

where r is the annual rate and r' the Effective

Annual Rate. ,

where r is the annual rate and r' the Effective

Annual Rate.

And the effective annual rate for continuous compounding is the solution

of r' from

,

where r is the annual rate and r' the Effective

Annual Rate. ,

where r is the annual rate and r' the Effective

Annual Rate.

Example 4.10 Find the possible balance(s) of a college fund with

an initial investment of $50,000 after 25 years if it allowed to grow at

an annual interest rate of 5.25% in the following portfolio or accounts:

Compounded Yearly, Monthly, Daily and Continuously. For each portfolio

find the effective annual rate.

Table 4.6 Investment Alternatives in Exponential Growth Funds:

| Compound Period |

Formula / Calculation

For Balance

, ,

|

Balance

after 25 years

where  |

Calculation

for Effective Annual Rate

(1+r'), where r' is the Effective Annual Rate |

Effective

Annual Rate, % |

| Yearly, n=1 |

|

$179,689.47 |

|

5.25% |

| Monthly, n=12 |

|

$185,241.48 |

|

5.378% |

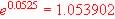

| Daily, n = 365 |

|

$185,755.00 |

|

5.3899% |

| Continuously n is large |

|

$185,772.54 |

|

5.39% |

Precalculus: Contemporary Models

by Pin D. Ling

|